Islamic account at XM

How Islamic accounts work and how to get started

Online currency trading should be fore everyone, that is why brokers now make sure to be available for traders from different backgrounds and beliefs. One example of this is the introduction of Islamic accounts, also known as Sharia-compliant or swap-free accounts.

These accounts are designed specifically for Muslim traders who follow Islamic laws, which prohibit earning or paying interest (Riba). So, islamic accounts do not charge interest on overnight positions, ensuring they meet the ethical and religious standards of Islamic finance.

Understanding Islamic Accounts

Islamic accounts differ from regular trading accounts in a few important ways, the main one being the removal of swap fees or overnight interest on open positions. This is in line with Islamic law, which prohibits Riba (interest).

Instead, brokers might charge a fixed commission or no additional fees, depending on the account type and platform. This setup allows Muslim traders to participate in currency trading while staying true to their religious principles.liefs.

Sharia certificate at XM

Islamic accounts also ensure immediate settlement of transactions, following the principles of Islamic finance. Trades are executed and settled instantly, promoting transparency and fairness in line with Islamic ethical standards.

How to Set Up an Islamic Account with XM

Opening an Islamic account with XM, a top currency trading broker, is simple and tailored to meet the needs of Muslim traders. Here’s a step-by-step guide to help you get started and smoothly transition to Sharia-compliant trading.

Step 1: Sign Up for a Trading Account

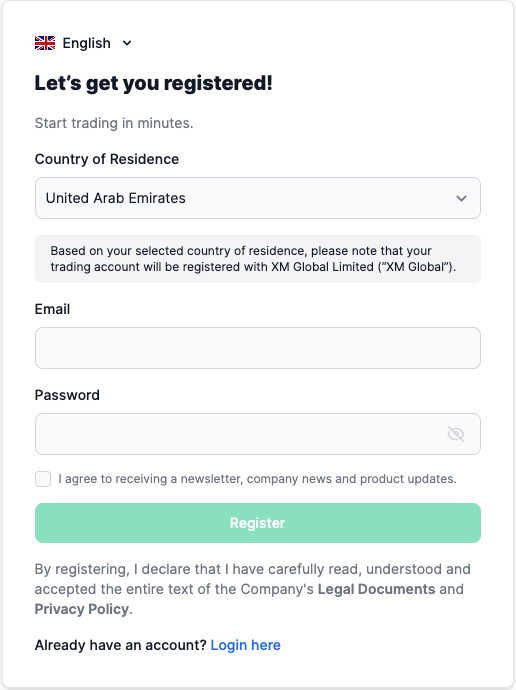

- Visit the FOREX ISLAMIC ACCOUNTS page and click on the “Open an Account” button.

- Fill in the registration form with your personal information, including your name, email address, and phone number.

- Choose your preferred trading platform and account type. XM offers various account types, so ensure you select one that qualifies for an Islamic account conversion.

Step 2: Account Verification

- To meet regulatory requirements, XM requires you to verify your account. So, submit a copy (screenshot or photo) of your valid passport or ID and a recent utility bill or bank statement as proof of address.

- Wait for the verification process to complete. XM will notify you once your account is verified, which typically takes a few business days.

Step 3: Request an Islamic Account

- Once your account is verified, log in to the XM Members Area.

- Go to the account settings or support section to find the option for converting your account to an Islamic account.

- Submit a request for an Islamic account. You may need to fill out a brief form or simply confirm your desire to switch to a swap-free account.

Step 4: Confirmation and Setup

- After submitting your request, XM will review your application to convert your account to an Islamic account. This process usually takes one to two business days.

- Once approved, you will receive a confirmation email from XM. Your account will now operate under the Islamic account conditions, with no swap fees on overnight positions.

Step 5: Start Trading

- With your Islamic account set up, you can now start trading. Log in to your trading platform using your XM account credentials.

- Begin trading from a wide range of currency pairs, ensuring your activities remain compliant with Islamic finance principles.

By following these steps, Muslim traders can easily open an Islamic account with XM, allowing them to trade currencies in a way that respects their religious beliefs. With no swap fees and full compliance with Islamic finance principles, these accounts offer a Sharia-compliant option for ethical trading.

How to change XM account to islamic

If you already have an XM account and wants to change it to islamic, this is how to to it:

To switch to a Swap-free trading account at XM, you basically need to ask a support agent for it. This is done by filling out a special form for an Islamic (Swap-free) account. Once the form is submitted, XM’s Back-Office team takes care of the rest. It’s a straightforward process that just requires the client’s go-ahead.